ASML is far from its all-time highs.

Given how popular some artificial intelligence (AI) stocks have become, many investors may feel like they’ve missed the boat. However, one of the main ways to invest in AI has just been sold.

ASML (ASML 0.63%) has a technology that no one else has, giving it the status of a technological monopoly. Without their tools, chip companies wouldn’t be able to make the same cutting-edge chips that push the limits of computing power. As a result, ASML is one of the most critical companies in the chip value chain, thus making it a major AI player.

However, as previously stated, ASML was sold only because of an earnings report that was not received. Is this a buying opportunity? Or is there a good reason it fell about 40% from its all-time high?

The ASML tool does not follow the chip cycle directly

ASML isn’t the cheapest stock on the market at $670 a share, but it’s a long way from its all-time high of nearly $1,100. Given ASML’s critical position in the chip value chain, it may surprise investors not to see this company at an all-time high. After all, Nvidia (NASDAQ: NVDA) sells more and more graphics processing units (GPUs) every quarter, which require a lot of chips made by Taiwan Semiconductor (NYSE: TSM) in a process that uses ASML tools.

However, the main thing to remember about ASML is that it is not directly related to the chip business cycle. Orders for ASML lithography tools are placed years in advance, so the capacity currently being built for AI chips has already hit ASML’s books. Unfortunately for investors, this has forced management to lower its expectations for 2025.

Previously, management had expected between 30 billion and 40 billion euros for 2025. However, that guidance was reduced to 30 billion to 35 billion euros – a move that the market did not appreciate. After this news, the stock fell 20% in the next few trading days.

This decrease is due to China, which has been part of her business in recent years. In Q3, 47% of sales went to China, but in 2025, they project around 20% of sales – a more normal level historically. The business slowdown appears to have two factors (although management did not mention why in its earnings release).

First, Western governments don’t want China and its allies to get their hands on ASML’s latest devices, as this would allow them to produce the most technologically advanced chips. Through various export bans imposed by the Dutch (ASML is based in the Netherlands) and the US, ASML is already limited in what it can sell to China, and further restrictions have recently been implemented.

Second, there is an economic recession in China at the moment, which naturally slows down business expansion. Both of these factors are not doing ASML any favors, but they are very short-term headaches.

However, the management remains very optimistic about the future.

The future of ASML looks bright

Although investors did not appreciate the reduced guidance thanks to China, long-term investors should take into account this statement from ASML:

In summary, long-term trends remain very, very strong. Very, very positive, showing good upside signs. But the development over the last couple of months and the unique customer circumstances I’ve just mentioned has led to a more gradual growth curve for our business.

Basically, ASML is still strong; he just isn’t going to grow as fast as he expected. The 30 to 35 billion euro area management provided is still very strong, considering where 2024 revenues are expected to come in. For 2024, management projects 28 billion euros in revenue, so the 2025 management range would show a growth of 7.1% to 25%. If earnings come in at the lower end of guidance, I wouldn’t be surprised to see more investors head for the exits, but if it hits the upper end of guidance, ASML could saw a sharp recovery.

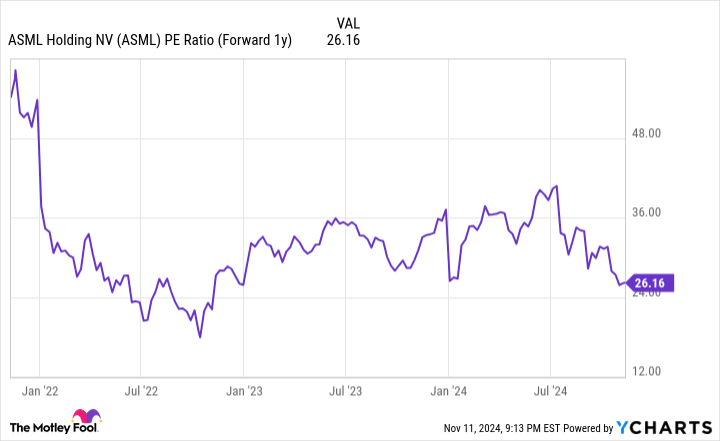

Today, the share price changed 26 times for 2025.

ASML PE ratio data (Forward 1y) by YCharts

That’s not a bad price, considering ASML is its own league and has no competition.

While ASML’s road may be bumpy over the next year, it still looks like smooth sailing in the long term. Investing in ASML is a guarantee that we will have to build out more chip capacity over the next few years. That’s as unpredictable as we get in the investment world, and ASML will be a big contributor to this trend.

Keithen Drury holds positions in ASML and Taiwan Semiconductor Manufacturing. The Motley Fool has positions and recommends ASML, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

#artificial #intelligence #stocks #sale #Motley #Fool