Dublin, Nov. 14, 2024 (GLOBE NEWSWIRE) — The “Money Transfer App Market – Global Industry Size, Share, Trends, Opportunity and Forecast, 2019-2029F” report has been added. ResearchAndMarkets.com’s offers.

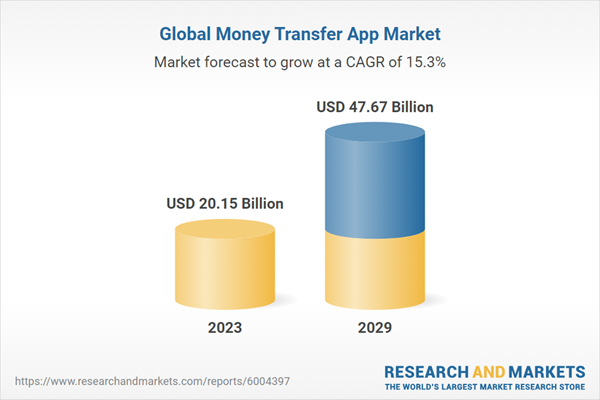

The Global Money Transfer App Market was valued at $20.15 Billion in 2023 and is expected to grow strongly during the forecast period with a CAGR of 15.26% through 2029, reaching $47.67 one billion.

The global money transfer app market has seen significant growth and transformation over the past decade, driven by technological advances, increased smartphone penetration, and a shift towards digital financial solutions . Money transfer apps have revolutionized the way individuals and businesses conduct financial transactions, offering a convenient, fast and cost-effective alternative to traditional banking and payment services. This market is characterized by a wide range of players, including established financial institutions, fintech startups, and tech giants, all competing to capture a share of the growing demand for digital payment solutions. to catch

One of the main drivers of growth in the money transfer app market is the adoption of smartphones and mobile internet. With billions of smartphones in use globally, consumers have unprecedented access to mobile financial services. This has been particularly transformative in developing regions, where traditional banking infrastructure may be lacking. Mobile money transfer apps provide an accessible financial tool for the unbanked and underbanked, enabling them to participate in the formal financial system, make payments, receive funds, and manage their finances. more effective management.

Another important factor contributing to the expansion of the market is the growing trend of globalization and the resulting increase in cross-border transactions. As more people move across borders for work, study, or leisure, the demand for efficient and affordable international money transfer services has increased. Money transfer apps have responded to this need by offering competitive exchange rates, low transaction fees, and fast transfer times, making them an attractive option for sending money internationally. This has been particularly beneficial for migrant workers who rely on remittances to support their families back home.

Key market drivers:

- Increasing smartphone mobility and mobile internet access

- Global Rise and Cross-Border Transactions

- Innovation and technological advances

- Increasing Focus on Financial Inclusion

Key Market Challenges:

- Regulatory Compliance and Fragmentation

- Security and fraud prevention

- High competition and market saturation

- Technology Infrastructure and Integration

- Customer trust and customer acceptance

Key market trends:

- Integration with digital wallets and e-commerce platforms

- The Rise of Blockchain and Cryptocurrency in Money Transfer

- Focus on Better Security and Fraud Prevention

- Expansion into New Markets

- Personalization and Customer Experience Improvement

Regional views

North America dominated the global money transfer market in 2023. North America has a highly advanced digital infrastructure that supports the widespread use of money transfer apps. High internet penetration rates, combined with the widespread use of smartphones, create a strong foundation for digital financial transactions. This technological readiness allows users to access and use money transfer apps seamlessly, adding to the region’s leadership.

The regulatory environment in North America is supportive of fintech innovation. Regulatory agencies in the United States and Canada have implemented frameworks that encourage the development and use of digital financial services. These rules ensure consumer protection while encouraging competition and innovation among service providers. The supportive regulatory landscape allows money transfer apps to thrive and expand their offerings, increasing consumer trust and adoption.

Diverse consumer demand in North America also plays an important role in the growth of the market. The area is home to a large population of immigrants and tourists who regularly send money to their home countries. Money transfer apps provide a convenient, fast and cost-effective solution for these cross-border transactions. In addition, the tech-savvy population in North America prefers the convenience and efficiency of digital payments over traditional methods, driving further adoption of money transfer apps.

North America’s dominance is also boosted by the strong presence of established financial institutions and tech giants. Companies like PayPal, Venmo, and Square, along with major banks, have developed sophisticated money transfer solutions that fit a wide range of consumer needs. These companies leverage their extensive resources, technology and customer bases to customize and offer better services, setting high standards in the market.

The emphasis on security and compliance is another critical factor. With growing concerns about cybersecurity, North American money transfer app providers are investing heavily in advanced security measures such as encryption, biometric authentication, and fraud detection technologies. This focus on security gives consumers confidence and fosters trust in digital financial services.

The growing cross-border trade and e-commerce activities in North America are contributing significantly to the growth of the market. The increase in international business transactions and online shopping requires efficient money transfer solutions, further increasing the demand for these applications. Money transfer apps enable seamless payments for consumers and businesses, increasing their appeal in the sector.

Key players profiled in this Money Transfer App market report:

- Information about PayPal Holdings, Inc.

- Information about Western Union Financial Services, Inc.

- Smart Payments Limited

- Remitly, Inc.

- WorldRemit Ltd.

- Revolut Ltd.

- Information about the company MoneyGram Payment Services, Inc.

- Azimo Ltd.

- Square, Inc.

- Information about the company Paysafe Holdings UK Limited

Reporting area

In this report, the Global Money Transfer App Market is segmented into the following segments:

By User:

By Activity Type:

- Domestic transfers

- International trends

By Business Model:

- Freemium model

- Flat Tax Model

- Transfer Tax Model

By region:

- North America

- Europe

- South America

- Asia-Pacific

- Middle East & Africa

Key features

| Impact Statement | Details |

| Number of pages | 185 |

| The preview period | 2023-2029 |

| Estimated market value (USD) in 2023 | $20.15 billion |

| Expected market value (USD) by 2029 | $47.67 billion |

| Compound annual growth rate | 15.2% |

| Categories covered | Global |

For more information on this report visit https://www.researchandmarkets.com/r/f3gjgm

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, leading companies, new products and the latest trends.

-

Global Money Transfer App Market

#Money #Transfer #Apps #Industry #Billion #Regional #Markets #Analysis #Profiles #Key #Players #PayPal #Western #Union #Financial #Services #Smart #Payments #Remitly #WorldRemit #Revolut